Get the free truck driver tax deductions worksheet

Show details

LONG HAUL/OVERNIGHT TRUCK DRIVER DEDUCTIONS

The purpose of this worksheet is to help you organize your tax-deductible business expenses. In order for an expense to be

deductible, it must be considered

We are not affiliated with any brand or entity on this form

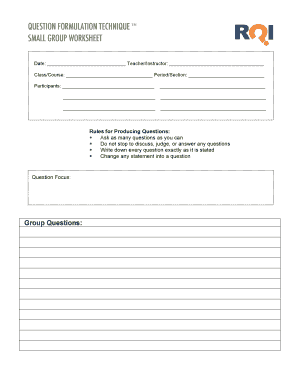

Get, Create, Make and Sign owner operator trucking expenses spreadsheet download form

Edit your 1 truck driver expense sheet form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your truck driver expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit owner operator tax deductions worksheet online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pdffiller form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out owner operator tax deductions list pdf form

How to fill out truck driver tax deductions:

01

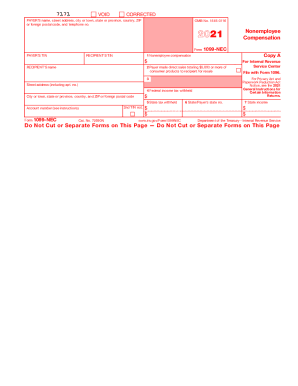

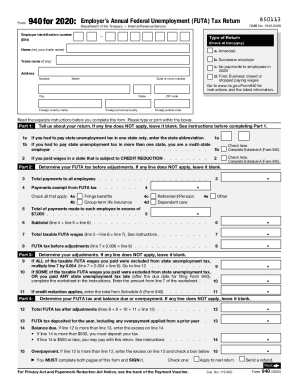

Gather all necessary documents, including your W-2 forms, 1099 forms, expense receipts, and mileage logs.

02

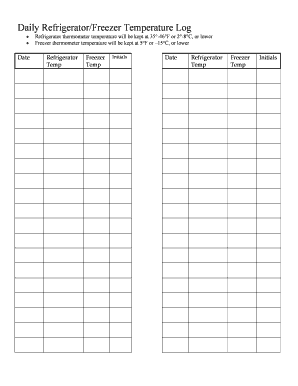

Organize your expenses into categories such as fuel, maintenance, meals, and lodging.

03

Keep track of your miles driven for business purposes and separate them from personal mileage.

04

Determine if you are eligible for any deductions or credits specific to truck drivers, such as per diem expenses or the fuel tax credit.

05

Use a reliable tax software or consult with a tax professional to ensure accurate and efficient completion of your tax forms.

06

Submit your completed tax forms, along with any necessary supporting documents, by the deadline.

Who needs truck driver tax deductions:

01

Truck drivers who are self-employed or operate as independent contractors need tax deductions to minimize their tax liability and maximize their profits.

02

Truck drivers who are employees of a company may also need tax deductions if they have unreimbursed job expenses or qualify for specific deductions related to their occupation.

03

Truck drivers who own their own truck and are responsible for its maintenance and operating costs can benefit from tax deductions to offset these expenses and reduce their taxable income.

Fill

trucker tax deduction worksheet

: Try Risk Free

People Also Ask about small business tax deductions worksheet

Are DOT meals 100 deductible?

Section 210 of the act temporarily raised the allowance of business meals (for food or beverages provided by a restaurant) under IRC § 274(n) to 100% from 50% for tax years 2021 and 2022.

How much is self employed mileage deduction in Canada?

What Is The CRA Mileage Rate For Business? The current CRA mileage rate for businesses in 2022 stands at $0.61 per kilometer for the first 5000 kilometers driven. After which the rate falls to $0.55 per kilometer driven for business purposes.

What deductions can truck drivers claim?

19 truck driver tax deductions that will save you money Insurance premiums. You can deduct the cost of business-related insurance premiums as a business expense. Association dues. Cell phone plans. Personal electronic devices. Education. Meal expenses. Medical expenses. Business clothing.

What deductions can I claim as a truck driver?

19 truck driver tax deductions that will save you money Insurance premiums. You can deduct the cost of business-related insurance premiums as a business expense. Association dues. Cell phone plans. Personal electronic devices. Education. Meal expenses. Medical expenses. Business clothing.

Can truck drivers claim per diem on taxes?

As a result of the Tax Cuts and Jobs Act, employees known also as company drivers are no longer eligible to claim the Per Diem deduction.

What can a owner operator truck driver write off on taxes?

Tax Deductions for Owner-Operators & Truck Drivers Truck lease. Permits and license fees. Repairs and accessories. Fuel and fuel-tax. Start-up costs. Interest paid on business loans. Accounting services. Depreciable property.

What deductions can a truck driver claim?

19 truck driver tax deductions that will save you money Insurance premiums. You can deduct the cost of business-related insurance premiums as a business expense. Association dues. Cell phone plans. Personal electronic devices. Education. Meal expenses. Medical expenses. Business clothing.

How much can a truck driver write off for meals?

While the IRS allows most industries to deduct 50% of meals, drivers subject to the Department of Transportation's “hours of service” limits, can claim 80% of their actual meal expenses.

How much does IRS allow for meals per day?

The amount of the $297 high rate and $204 low rate that is treated as paid for meals for purposes of § 274(n) is $74 for travel to any high- cost locality and $64 for travel to any other locality within CONUS. See section 5.02 of Rev. Proc. 2019-48 (or successor).

What can I write off as a delivery driver Canada?

The types of expenses you can deduct include: fuel (such as gasoline, propane, and oil) and electricity. maintenance and repairs. insurance. licence and registration fees. capital cost allowance. eligible interest you paid on a loan used to buy the motor vehicle. eligible leasing costs.

Can owner-operators write off mileage?

Personal Vehicle Mileage: Any miles traveled in your personal vehicle related to your business, such as a trip to the store to pick up supplies or driving to the mechanic to drop of a truck, is deductible. Keep records of dates, mileage, destination, and reason for the trip.

What can a truck driver owner-operator deduct on taxes?

Tax Deductions for Owner-Operators & Truck Drivers Truck lease. Permits and license fees. Repairs and accessories. Fuel and fuel-tax.

How much can a trucker deduct for meals per day?

A. The per diem rate for meals is 80% of $69 per day (effective 10-1-2021 thru 9-30-2022). The per diem rate for meals 1-1-2021 thru 9-30-21 was 80% of $66 per day and 10-1-2021 thru 12-31-2021 was 80% of $69 per day. The per diem rate for meals in 2020 was 80% of $66 per day.

Can you write off meals as a delivery driver?

Understanding meal write-offs. Rule of thumb: If eating on the job is not a requirement for employment, then it's not a legitimate business expense. That's why most meals aren't deductible for Uber drivers.

What expenses can I write off as a truck driver?

Here are eight tax write-offs for truck drivers. Insurance. Medical Expenses. Work Clothing, Meals, and Personal Products. Dispatch and Licensing Fees. Fuel and Other Travel-Related Costs. Truck/Vehicle Expenses. Education. Association Dues.

Can truck drivers claim meals on taxes?

The IRS does allow contractors and self-employed transportation workers, subject to the hours of service regulations that travel for business, to deduct their meal expenses from their income. The per diem rate is set by the IRS.

Is there a limit on meal deductions?

The deduction for unreimbursed non-entertainment-related business meals is generally subject to a 50% limitation. You generally can't deduct meal expenses unless you (or your employee) are present at the furnishing of the food or beverages and such expense is not lavish or extravagant under the circumstances.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit trucking expenses list pdf online?

The editing procedure is simple with pdfFiller. Open your owner operator expense sheet in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the truck driver tax deductions worksheet pdf electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your owner operator trucking expenses spreadsheet in minutes.

Can I create an electronic signature for signing my truck driver deductions spreadsheet in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your trucking expenses spreadsheet right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is truck driver tax deductions?

Truck driver tax deductions are specific expenses that truck drivers can deduct from their income when filing taxes, which reduces their taxable income and overall tax liability.

Who is required to file truck driver tax deductions?

Truck drivers who are self-employed or work as independent contractors are typically required to file truck driver tax deductions.

How to fill out truck driver tax deductions?

To fill out truck driver tax deductions, you need to gather all relevant receipts and documentation of expenses, complete the appropriate tax forms such as Schedule C, and list eligible deductions like fuel, maintenance, and travel costs.

What is the purpose of truck driver tax deductions?

The purpose of truck driver tax deductions is to allow drivers to lower their taxable income by accounting for legitimate business expenses incurred while performing their job.

What information must be reported on truck driver tax deductions?

Truck drivers must report information such as total income, detailed expenses (fuel costs, maintenance, meals, lodging, and any other necessary expenditures), and documentation to support these deductions.

Fill out your truck driver tax deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Owner Operator Truck Driver Tax Deductions Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to owner operator expense spreadsheet

Related to owner operator tax deductions list 2021

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.